Steel industry: Showdown in the battle of technologies

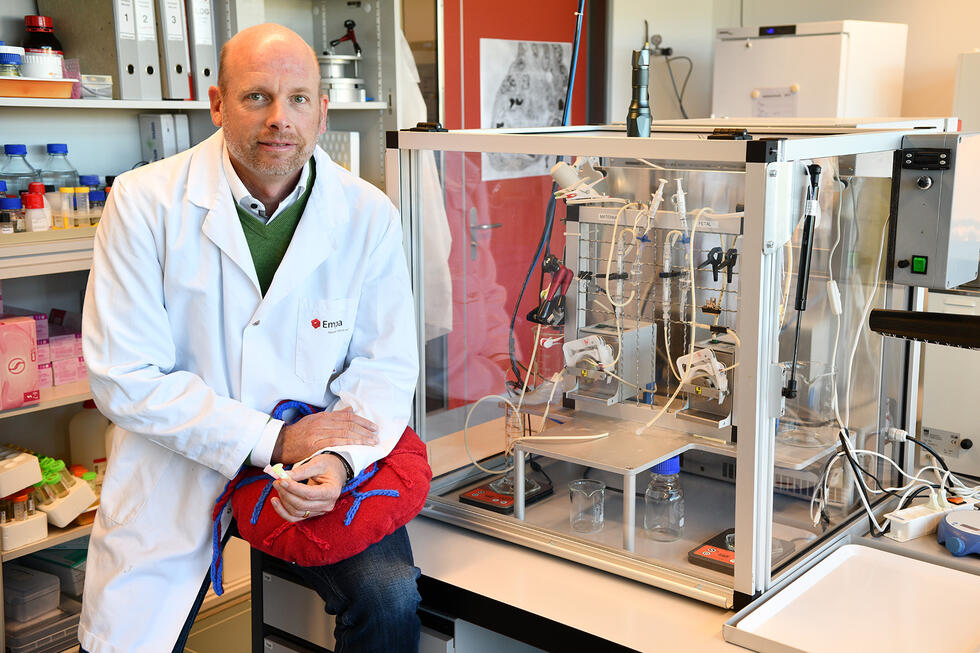

Green steel is no longer a vision of the future. The transition to more environmentally friendly production, on the other hand, is. Bernhard Rischka, Director of Corporate Technology at Swiss Steel Group, explains what it will take for the steel industry to shake off its image as a climate sinner.

Without steel, there would be no cars, no machines, no buildings. Nevertheless, the industry has been under pressure for years, suffering from overcapacity and trade barriers such as tariffs. At the same time, the European steel industry is expected to drive forward the transition to more environmentally friendly production in order to meet climate targets. Today, the global steel industry accounts for around 8 percent of CO2 emissions. The problem with the transformation is that it is time-consuming and cost-intensive, and for it to succeed, customers must be willing to pay more for environmentally friendly steel.

Mr. Rischka, how can steel production be made greener?

Conventional blast furnaces have the greatest potential for reduction: they use iron ore and fossil fuels, which results in emissions of over 2,000 kilograms of CO2 per ton of steel. Replacing them with electric arc furnaces could save around 90 percent.

Why is that?

Electric arc furnaces do not process iron ore, but mainly scrap metal. Green electricity is used instead of coke. The process has a very small carbon footprint – around 200 kilograms of CO₂ per ton of steel.

Is it realistic to expect blast furnaces to be replaced soon?

No. Because scrap alone is not enough to meet global demand: while there is a lot of scrap available in Europe and the US due to their long industrial history, this is not yet the case in countries with large steel production such as China or India. Iron ore is still primarily used there, and sustainable energy sources are lacking. A widespread conversion will therefore probably only be possible in these countries in 10 to 20 years.

So there's no way around iron ore for the time being?

Yes. But there are still ways to reduce emissions: if coke is used instead of natural gas to reduce the proportion of iron ore, CO₂ emissions per ton of steel fall to around 1,000 kg. This is possible, for example, with the so-called direct reduction process. Replacing natural gas with green hydrogen reduces CO₂ emissions by a further 70 to 80 percent. However, green hydrogen is currently still scarce and three to five times more expensive than natural gas.

Despite these substitutions, emissions remain. Is the label “green” still accurate?

The term “green” is not protected and is ultimately a marketing term. There are certainly companies that misuse it for greenwashing purposes. Nevertheless, I believe that companies with a comparatively high carbon footprint and low scrap content should have the opportunity to legitimately label their steel as green – provided they make progress. This is made possible by a sliding scale model for evaluation: the decisive factor is not the absolute CO₂ emissions, but how much they have been reduced. Those who halve their emissions, for example, qualify for better label levels.

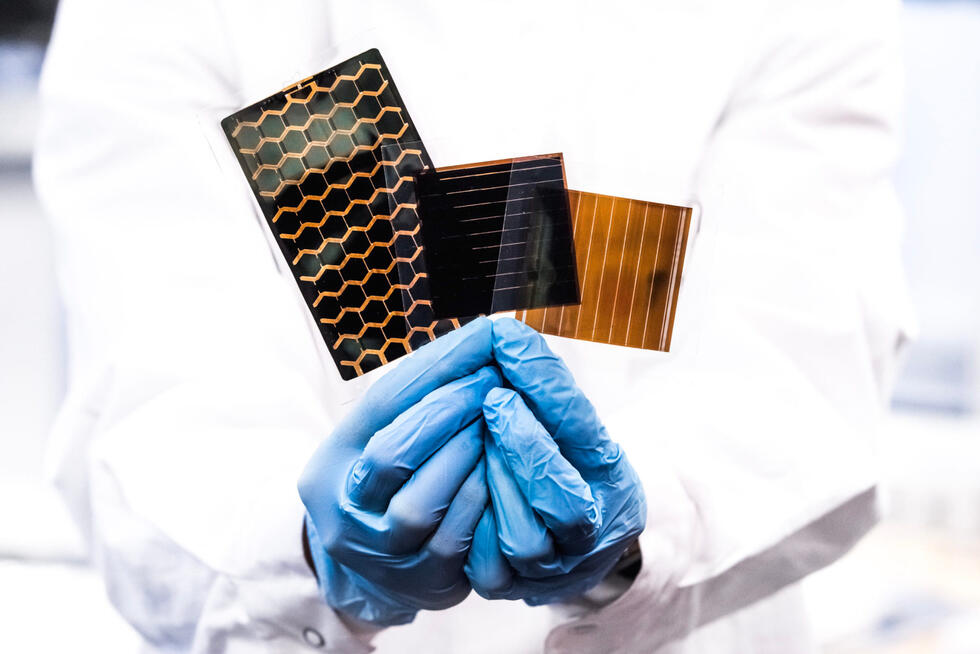

What is green steel?

Green steel is an environmentally friendly variant of steel. It differs from conventional steel in two ways: the raw material and the energy source. Instead of iron ore, recycled scrap is used, and instead of a fossil fuel, a renewable energy source is used.

Two processes dominate production:

- 1. In an electric arc furnace, scrap metal is melted down and reprocessed – a circular process with significantly lower CO₂ emissions, namely around 200–500 kg CO₂ per ton of steel. Both Swiss steelworks operate according to this principle.

- 2. Production in a blast furnace is based on iron ore, which is reduced with the aid of carbon (usually coke). This process generates around 2 tons of CO₂ per ton of steel – many times more. The blast furnace remains the global standard in steel production.

How meaningful are labels for green steel?

Currently only to a limited extent. The various certifications are inconsistent, non-transparent, and in some cases influenced by the interests of large producers. There is currently no internationally binding labeling system. This makes it difficult for customers to objectively assess the ecological value of a product.

But would customers be interested?

Yes, interest is growing significantly. Our customers are increasingly asking for reliable climate data. That is why the Swiss Steel Group relies on the Product Carbon Footprint (PCF): an exact CO₂ balance per product, based on the entire manufacturing process. This provides customers with transparent, verifiable data – and allows them to assess for themselves whether the emissions meet their requirements.

Where is green steel particularly in demand?

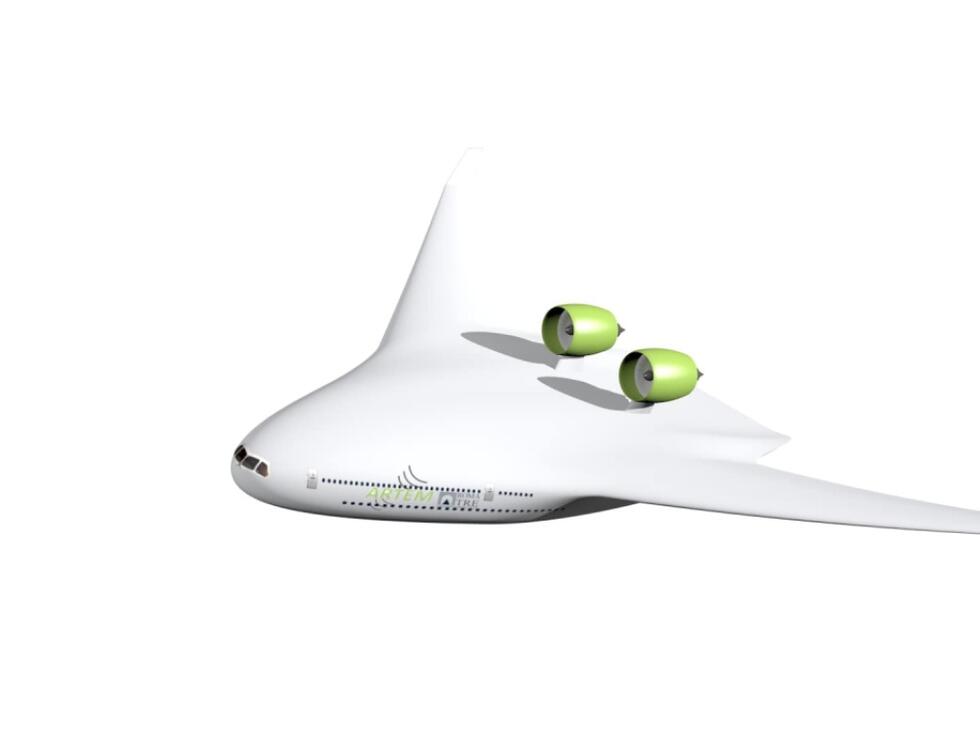

From an industry perspective, it is most in demand in the automotive industry, where the pressure to reduce CO₂ emissions is particularly high. However, industries such as aviation, wind power, rail vehicles, and mechanical engineering are also showing increasing interest. However, there are major differences around the world: In Europe, strict ESG requirements, sustainability reports, and supply chain laws create clear incentives to use climate-friendly steel. In the US, regulatory pressure is significantly lower. And in China and India, for example, around 90 percent of production is still based on iron ore.

Swiss Steel Group

The Swiss Steel Group, based in Lucerne, is an internationally active special steel manufacturer that produces exclusively from scrap in electric arc furnaces – i.e., completely circular. The group operates plants in Switzerland, Germany, France, Canada, and the US. Its focus is on high-quality steel solutions for the automotive, rail, and aviation industries, for wind power, and for oil and gas applications. The Swiss Steel Group is one of the pioneers in CO₂-reduced steel production. However, due to its degree of specialization, it is not representative of the global steel industry.

What about profitability – is the production of green steel even worthwhile?

Green steel is undoubtedly more expensive – due to energy costs, more complex logistics, and necessary investments. However, end customers are becoming more accepting of higher costs. For manufacturers and the processing industry, this means a clear competitive advantage – in terms of market access, image, and also in attracting skilled workers. Price remains a key criterion, but the green argument is recognized as an added benefit.

What does it take to successfully scale up the production of green steel?

Firstly, functioning material cycles: cross-border scrap trading is currently being slowed down by regulations such as the Waste Shipment Act – more flexibility is needed here. At the same time, companies must separate and store scrap by type. This is a logistical feat. Secondly, sufficient clean energy is needed: Green electricity must be available in sufficient quantities and reliably. This also means that countries such as Germany must significantly reduce their emissions per megawatt hour – currently they are around 380 kg CO₂, while Switzerland, due to its energy mix, is at 20 kg. And thirdly, fair competitive conditions are needed.

How fairly is competition currently regulated?

An important step has been taken with the CO₂ border adjustment mechanism (CBAM). It makes imports from countries with lower climate standards more expensive – a compensation that ensures greater fairness. However, this does not apply to exports to these countries. And even from a global perspective, the playing field remains uneven: different climate targets and timetables continue to distort market conditions – to the detriment of ambitious regions such as Europe.

So are Europe's efforts just a drop in the ocean?

Europe's pioneering role is important – as a technological and political role model for other markets. But in terms of emissions, its influence is limited: the EU accounts for only 5 to 6 percent of global steel production. In the long term, it will depend on major players such as China and India.

Written by: Isabel Hempen

Illustration: Itziar Barrios